Applied statistics plays a crucial role in business and economics by enabling data-driven decisions, solving complex problems, and analyzing market trends effectively․

1․1 Overview of Applied Statistics

Applied statistics involves the collection, analysis, and interpretation of data to make informed decisions in business and economics․ It uses statistical methods to solve real-world problems, such as market trends, forecasting, and operational efficiency․ By applying tools like regression analysis and data visualization, businesses can transform raw data into actionable insights․ This field emphasizes practical applications over theoretical concepts, making it essential for optimizing strategies and understanding economic patterns․ The integration of statistical software and data analytics further enhances its utility, enabling organizations to leverage data-driven approaches for competitive advantage and sustainable growth․

1․2 Importance of Statistics in Business and Economics

Statistics is essential in business and economics for making informed decisions, analyzing market trends, and forecasting future outcomes․ It enables organizations to understand customer behavior, optimize operations, and manage risks effectively․ By applying statistical methods, businesses can identify patterns, measure performance, and evaluate the impact of strategic decisions․ In economics, statistics helps in understanding GDP, inflation, and employment rates, which are critical for policy-making․ The ability to collect, analyze, and interpret data provides a competitive edge, ensuring businesses and economies remain resilient and adaptive in an ever-changing environment․ Thus, statistics is a cornerstone of modern business and economic practices․

1․3 Brief History of Applied Statistics

Applied statistics has evolved significantly since its origins in the 17th century, when it was primarily used for demographic studies․ By the 19th century, it expanded into economics and social sciences, with pioneers like Carl Friedrich Gauss and Karl Pearson laying the groundwork for modern statistical methods․ The 20th century saw the rise of computational tools, enabling widespread use in business and economics․ Today, applied statistics is integral for data-driven decision-making, forecasting, and risk management․ Its history reflects the growing need for empirical analysis to solve real-world problems, making it a cornerstone of modern business and economic practices․

Key Concepts in Applied Statistics

Applied statistics involves fundamental elements like data analysis, probability distributions, and regression analysis, essential for understanding and interpreting data in business and economic contexts effectively․

2․1 Types of Data in Business and Economics

In business and economics, data is categorized into quantitative and qualitative types․ Quantitative data includes numerical values like sales figures and GDP, while qualitative data involves non-numerical information such as customer feedback․ Additionally, data can be classified as cross-sectional, gathered at a single point in time, or time-series, collected over multiple periods․ Understanding these data types is crucial for accurate analysis and informed decision-making in various business and economic scenarios․

2․2 Probability Distributions

Probability distributions are essential tools in applied statistics, describing the likelihood of outcomes for random variables․ Common distributions include the Normal (bell-shaped), Binomial (for binary outcomes), and Poisson (for rare events)․ These distributions help model uncertainty in business and economics, such as forecasting sales or analyzing market risks․ Understanding probability distributions enables better decision-making by quantifying uncertainty and predicting future events based on historical data․ They are widely used in financial modeling, risk assessment, and operational planning, providing a statistical foundation for analyzing variability and making informed strategic choices․

2․3 Regression Analysis

Regression analysis is a statistical method used to establish relationships between variables, helping predict outcomes based on historical data․ In business and economics, it is commonly applied to model the relationship between a dependent variable (e․g․, sales) and one or more independent variables (e․g․, price, advertising); Simple and multiple regression are widely used techniques, enabling businesses to forecast trends, identify key drivers of outcomes, and support decision-making․ By analyzing coefficients and R-squared values, organizations can assess the strength and significance of these relationships, making regression a powerful tool for strategic planning and operational efficiency in data-driven environments․

Tools and Techniques in Applied Statistics

Statistical software like R, Python, and Excel, along with data visualization tools and big data analytics, are essential for analyzing and interpreting data in business and economics․

3․1 Statistical Software (R, Python, Excel)

Statistical software such as R, Python, and Excel are indispensable tools for data analysis in business and economics․ R and Python offer advanced programming capabilities for complex statistical modeling and machine learning, while Excel provides user-friendly interfaces for basic data analysis and visualization․ These tools enable businesses to process large datasets, perform regression analysis, and create visual representations of trends․ Python’s libraries, like Pandas and NumPy, simplify data manipulation, whereas R excels in advanced statistical modeling․ Excel remains a staple for quick computations and graphical representations․ Together, these tools empower professionals to extract actionable insights, supporting informed decision-making in dynamic business environments․

3․2 Data Visualization Tools

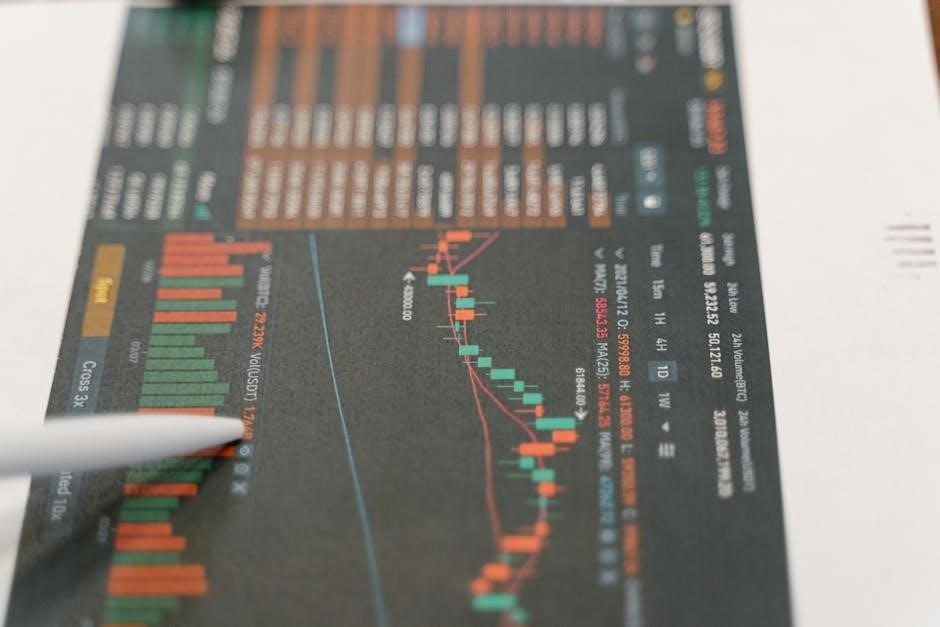

Data visualization tools are essential for presenting statistical insights in a clear and understandable manner․ Tools like Tableau, Power BI, and D3․js enable users to create interactive and dynamic visualizations, making complex data accessible to stakeholders․ These tools support various chart types, such as bar graphs, line charts, and heatmaps, to effectively communicate trends and patterns․ By transforming raw data into visual stories, businesses can make informed decisions and identify key opportunities․ Advanced features like real-time updates and customization further enhance the utility of these tools, ensuring that data-driven insights are both actionable and impactful in business and economic contexts․

3․3 Big Data Analytics

Big data analytics is a powerful approach to extracting insights from large, complex datasets, crucial for modern business and economic decision-making․ It leverages advanced technologies like Hadoop and Spark to process vast amounts of structured and unstructured data․ By applying statistical methods, organizations can uncover hidden patterns, predict trends, and optimize operations․ Big data analytics enables real-time data processing, allowing businesses to respond swiftly to market changes and customer needs․ Its applications span from improving forecasting accuracy to enhancing supply chain efficiency, making it a vital tool for competitive advantage in today’s data-driven economy․ It transforms raw data into actionable intelligence․

Applications of Applied Statistics

Applied statistics drives decision-making in business and economics through market research, financial forecasting, and supply chain optimization, enhancing efficiency and innovation across industries․

4․1 Market Research and Analysis

Applied statistics is essential for market research and analysis, enabling businesses to understand customer needs, preferences, and behaviors․ By analyzing data, companies can identify market trends, segment audiences, and measure the effectiveness of marketing campaigns․ Statistical tools like regression analysis and hypothesis testing help in making informed decisions․ Data visualization tools further enhance the presentation of insights, making complex data accessible․ This process supports strategic planning, competitive advantage, and overall business growth by ensuring that marketing strategies are data-driven and aligned with consumer demands and market dynamics․ Effective market research fosters innovation and helps businesses stay ahead in competitive landscapes․

4․2 Financial Modeling and Forecasting

Applied statistics is fundamental to financial modeling and forecasting, enabling businesses to predict future trends and make informed investment decisions․ Statistical techniques like regression analysis and time-series modeling help in analyzing historical data to forecast revenue, expenses, and market trends․ These models support the creation of accurate financial plans and budgets, ensuring alignment with organizational goals․

By leveraging statistical tools, businesses can identify patterns, assess risks, and optimize financial strategies․ This process enhances decision-making, reduces uncertainty, and drives long-term financial stability․ Effective financial forecasting is crucial for maintaining competitive advantage and achieving sustainable growth in dynamic economic environments․

4․3 Supply Chain Optimization

Applied statistics significantly enhances supply chain optimization by enabling businesses to analyze and predict demand, manage inventory, and streamline logistics․ Statistical models help identify trends and patterns in supply chain data, allowing for more accurate forecasting and efficient resource allocation․ Techniques such as regression analysis and time-series modeling are used to optimize inventory levels, reducing stockouts and overstocking․ Additionally, statistical tools facilitate the identification of bottlenecks and inefficiencies, enabling companies to improve operational performance and reduce costs․ By leveraging data-driven insights, organizations can achieve a more resilient and responsive supply chain, ultimately enhancing customer satisfaction and competitiveness in the market․

Benefits of Using Applied Statistics

Applied statistics enhances business and economic decision-making by providing actionable insights, improving operational efficiency, and enabling organizations to innovate and adapt to market changes effectively․

5․1 Data-Driven Decision Making

Data-driven decision making (DDDM) is a core benefit of applied statistics, enabling businesses to base decisions on empirical evidence rather than intuition․ By analyzing data, organizations can uncover trends, optimize operations, and predict future outcomes․ Applied statistics provides tools like regression analysis and probability distributions to support DDDM․ This approach enhances accuracy, consistency, and transparency in decision-making processes․ For instance, businesses can use statistical models to forecast market trends or understand customer behavior․ The 7th edition PDF delves into practical applications, offering methodologies to transform raw data into actionable insights, thereby fostering informed and strategic business practices․

5․2 Competitive Advantage

Applied statistics equips businesses with a powerful tool to gain a competitive edge by leveraging data analysis․ Organizations can identify market trends, optimize resources, and predict consumer behavior with precision․ Statistical techniques like regression models and probability distributions enable companies to make informed decisions, reducing uncertainty․ By analyzing data, businesses can uncover hidden opportunities and develop strategies that set them apart from competitors․ The 7th edition PDF emphasizes how statistical insights can drive innovation and efficiency, ultimately enhancing a company’s market position․ This data-centric approach ensures businesses stay ahead in a rapidly evolving economic landscape by making smarter, evidence-based decisions․ Statistics empower businesses to thrive․

5․3 Risk Management

Applied statistics is a vital tool for effective risk management in business and economics․ By analyzing data, organizations can identify potential risks, assess their likelihood, and mitigate their impact․ Statistical techniques such as regression analysis and probability distributions enable businesses to predict market fluctuations and operational challenges․ This proactive approach allows companies to develop contingency plans and allocate resources efficiently․ The 7th edition PDF highlights how statistical models can simulate various scenarios, helping organizations prepare for uncertainties․ By leveraging data insights, businesses can minimize losses and maximize opportunities, ensuring stability and resilience in an ever-changing economic environment․ Statistics empower informed risk management strategies․

Accessing the 7th Edition PDF

The 7th edition PDF can be accessed through official sources, ensuring legal compliance and avoiding unauthorized downloads․ Digital libraries and publisher websites offer secure and verified access․

6․1 Official Sources for Download

To legally access the 7th edition PDF, visit the official publisher’s website or authorized online retailers like Amazon or VitalSource․ These platforms ensure authenticity and compliance with copyright laws․ Additionally, academic databases and e-libraries subscribed by universities often provide access to the eBook․ Purchasing directly from the publisher guarantees the latest version and supports the authors․ Always avoid unauthorized sites to prevent downloading pirated or outdated copies․ Official sources offer secure, high-quality downloads, protecting both your device and intellectual property rights․

6․2 Legal Considerations

Accessing copyrighted material like the 7th edition PDF without authorization is illegal and violates intellectual property rights․ Downloading from unauthorized sources may expose you to legal penalties, malware, and outdated content․ Always purchase or download from official publishers or authorized retailers to ensure compliance with copyright laws․ Sharing or distributing copyrighted material without permission is also prohibited․ Respect intellectual property rights by obtaining legal copies, which support authors and publishers․ Additionally, be aware of data protection laws, such as GDPR, when handling digital content․ Legal downloading ensures both compliance and access to authentic, high-quality educational resources․

6․3 Alternative Formats

The 7th edition of “Applied Statistics in Business and Economics” is available in various formats to cater to different preferences and needs․ Beyond the PDF, readers can access e-book versions, hardcover, and paperback copies․ Audiobook formats are also available, enabling learning on the go․ Additionally, some platforms offer interactive online resources and study guides to complement the textbook․ Accessibility options, such as large print or screen-reader compatible versions, ensure inclusivity for all learners․ These diverse formats provide flexibility, making the content accessible and convenient for students and professionals alike․

Supplementary Resources

Supplementary resources include companion websites, online tutorials, and study guides, providing additional support for mastering applied statistics concepts and practical applications in business and economics․

7․1 Companion Websites

Companion websites offer comprehensive support for applied statistics in business and economics․ These platforms provide access to datasets, interactive exercises, and multimedia resources that enhance learning․ They often include chapter-specific materials, such as quizzes, video lectures, and downloadable templates․ Additionally, these websites may host discussion forums where students can interact with peers and instructors․ Some companion sites also feature tools for data analysis, enabling hands-on practice with real-world data․ By leveraging these resources, learners can deepen their understanding of key concepts and apply statistical methods effectively in various business and economic scenarios․

7․2 Online Tutorials

Online tutorials provide step-by-step guidance for mastering applied statistics in business and economics․ These resources often include video lectures, interactive exercises, and step-by-step solutions to textbook problems․ Tutorials may cover topics like data analysis, regression models, and probability distributions, offering practical examples․ They are designed to complement the textbook, helping learners grasp complex concepts through visual and interactive methods․ Many tutorials also include practice datasets, allowing users to apply statistical techniques firsthand․ By leveraging these tools, students can reinforce their understanding and improve their analytical skills in a self-paced learning environment․ This makes online tutorials an invaluable resource for both beginners and advanced learners․

7․3 Study Guides

Study guides are comprehensive resources designed to help students master the concepts of applied statistics in business and economics․ They often include chapter summaries, practice quizzes, and key formulas to reinforce learning․ These guides provide step-by-step solutions to textbook problems, enabling students to understand complex statistical methods․ Additionally, they may offer practical examples and case studies to illustrate real-world applications․ Study guides are particularly useful for exam preparation, as they focus on essential topics and frequently asked questions․ By using these tools, learners can identify areas needing improvement and develop a deeper understanding of statistical principles, enhancing their analytical skills for academic and professional success․

Impact on Business Decision Making

Applied statistics empowers businesses to make informed decisions by analyzing data, forecasting trends, and reducing uncertainty, leading to strategic planning and operational efficiency․

8․1 Strategic Planning

Applied statistics significantly influences strategic planning by providing businesses with actionable insights․ By analyzing market trends, customer behavior, and competitive landscapes, companies can formulate strategies that align with their goals․ Statistical tools enable forecasting, helping organizations anticipate future challenges and opportunities․ This data-driven approach minimizes uncertainty and enhances decision-making, ensuring resources are allocated effectively․ For instance, regression analysis can predict market demands, while probability distributions can assess risks․ These insights empower leaders to create informed strategies, fostering innovation and sustainability․ In essence, applied statistics transforms raw data into a roadmap for achieving long-term objectives, making it indispensable for modern business strategy development․

8․2 Operational Efficiency

Applied statistics enhances operational efficiency by optimizing business processes and reducing costs․ Through data analysis, companies can identify bottlenecks, streamline workflows, and improve resource allocation․ Statistical methods such as regression analysis and hypothesis testing enable organizations to make data-driven decisions, ensuring operational activities are performed at peak levels․ For example, statistical process control helps maintain quality standards, while predictive analytics can forecast demand, reducing waste and overstock․ By leveraging statistical insights, businesses can automate tasks, enhance supply chain management, and improve customer satisfaction․ Ultimately, applied statistics empowers organizations to achieve leaner operations, driving overall performance and competitiveness in dynamic market environments․

8․3 Innovation

Applied statistics fuels innovation by enabling businesses to uncover hidden patterns, predict trends, and make informed decisions․ Statistical techniques like predictive analytics and hypothesis testing empower companies to experiment and refine new products or services․ For instance, A/B testing helps determine customer preferences, while regression analysis identifies key factors driving business outcomes․ By leveraging data, organizations can innovate strategies, optimize operations, and explore new markets․ Statistical insights also foster a culture of continuous improvement, encouraging businesses to adapt and evolve in response to changing market conditions․ This data-driven approach ensures that innovation is grounded in evidence, reducing risks and enhancing competitive advantage․

Future Trends in Applied Statistics

Applied statistics will increasingly integrate artificial intelligence, machine learning, and automation, enabling faster and more precise data analysis to drive informed business decisions and innovation․

9․1 Artificial Intelligence Integration

Artificial intelligence (AI) is revolutionizing applied statistics by automating complex data analysis tasks and enhancing decision-making processes․ Machine learning algorithms, powered by AI, enable businesses to uncover hidden patterns and predict future trends with greater accuracy․ Natural language processing (NLP) tools can analyze vast amounts of unstructured data, such as customer feedback, to extract actionable insights․ AI-driven statistical models optimize forecasting, risk assessment, and operational efficiency․ Moreover, AI integrates seamlessly with big data analytics, allowing real-time processing of large datasets․ This integration empowers organizations to make data-driven decisions swiftly, driving innovation and maintaining a competitive edge in dynamic markets․ The future of applied statistics lies in AI’s transformative potential․

9․2 Machine Learning Applications

Machine learning applications are transforming applied statistics by enabling businesses to extract insights from complex data․ Techniques like predictive modeling, clustering, and classification allow organizations to forecast demand, segment customers, and detect anomalies․ In economics, machine learning aids in analyzing large datasets to understand trends and policy impacts․ Automated decision-making tools optimize supply chains and pricing strategies․ These applications complement traditional statistical methods by handling vast, dynamic data efficiently․ By leveraging machine learning, businesses can uncover hidden patterns and make informed decisions, driving innovation and operational efficiency across industries․ This integration of statistics and machine learning fosters a data-centric approach to problem-solving and strategy development․

9․3 Real-Time Data Analysis

Real-time data analysis is revolutionizing applied statistics by enabling immediate insights from continuously generated data․ Businesses leverage tools like dashboards and streaming analytics to monitor trends, detect anomalies, and respond swiftly to market changes․ In economics, real-time data helps track fiscal indicators, allowing policymakers to make timely adjustments․ Sensors and IoT devices further enhance this capability by providing instant feedback․ This approach supports agile decision-making, operational efficiency, and innovation․ By processing data as it arrives, organizations can address challenges proactively, ensuring competitive advantage and optimal resource allocation․ Real-time analysis is essential for staying ahead in dynamic business and economic landscapes․